Phone: WA: +54 9 3814 45-9254

📅 Post Date: January 10, 2024 | 🔄 Updated: January 20, 2026

Monotributo in Argentina: Guide for Registration

Curious about what Monotributo is and how it can benefit you in Argentina? Monotributo stands as a Self-Employment or Self-Employed Entrepreneurship, which is an approachable option for small-scale taxpayers. It serves as a simplified taxation system, especially beneficial for individuals residing in Argentina who already have residency. In this comprehensive guide, we delve into the step-by-step Monotributo Argentina registration process, aiming to ease the navigation of doing a Sole Proprietorship for migrants in Argentina.

Under the Monotributo system, participants contribute through a single monthly fee that encompasses various taxes, including Income Tax and Value-Added Tax (VAT). The unique structure of this tax regime is strategically designed to simplify tax obligations, specifically catering to individuals with relatively smaller incomes and assets. Join us on this journey of Monotributo, making tax compliance a seamless experience for individuals like you.

Requirements for Obtaining Monotributo

Before starting the registration process, ensure you meet the eligibility criteria for Monotributo. Typically, this includes having an annual income within the Monotributo category limits and not being involved in certain excluded activities.

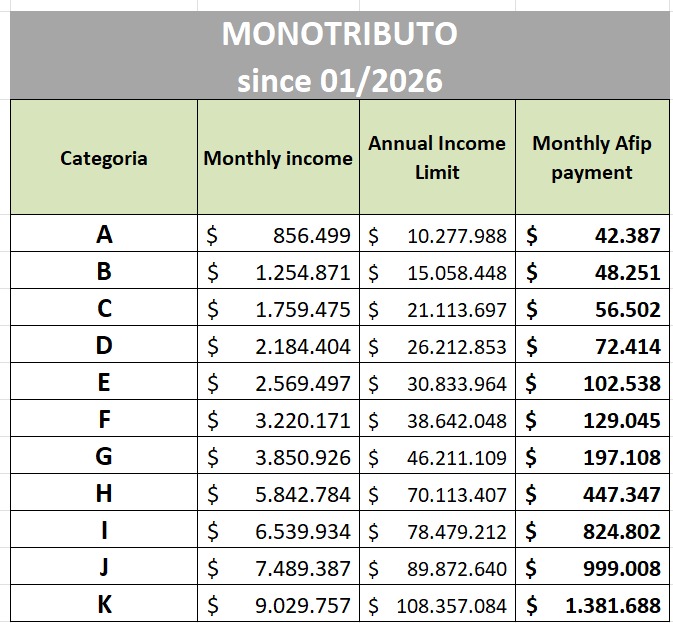

Here are the Monotributo categories and their annual income limits as of my last update.

In the Requirements paragraph below, we will provide detailed information on the documentation required for each procedure. Here is a summary of the requirements:

Gather the necessary documents, including:

– A photocopy of your ID or passport

– Proof of address (utility bill or rental agreement).

– Information about your business activities and location.

– Bank account information.

Step-by-Step Process to Register in This Simplified System

1. Log in with your CUIL and tax password.

2. Access the Digital Submissions service. If you don’t have it enabled, add it.

3. Then, enter and generate a “NUEVA PRESENTACIÓN DIGITAL”.

4. Select the procedure “ALTA CUIT PERSONAS HUMANAS – SITUACIONES ESPECIALES” or “SUCESIONES – VINCULACIÓN DE CLAVE FISCAL, CANCELACIÓN DE INSCRIPCIÓN Y OTROS” as appropriate.

Now, Let's Elaborate Steps In Detail:

1. Obtain your CUIT: Unique Tax Identification Code

CUIT (Social Security Number) is essential for registering in the Monotributo system, as it serves as a unique identifier for individuals and businesses to conduct transactions, issue invoices, and comply with tax obligations in Argentina.

If you don’t have a CUIT yet, it is crucial to obtain one. Visit the AFIP (Federal Administration of Public Revenues) website to complete this procedure.

Note: What is the difference between CUIL and CUIT?

CUIL = Workers’ Identification Number (We have discussed CUIL here)

CUIT = Individual Taxpayer Identification Number

You need to schedule an appointment and go to AFIP to obtain your tax password (Clave Fiscal). For this, you must bring the original and a copy of the following documents: your precaria, passport, and CUIL. At the appointment, you will complete two steps: (1) Clave Fiscal – you will receive a document with your tax password; please take a photo of it and send it to us, and do not change the password; (2) Datos Biométricos – they will take your photo and register it in the system.

2. Access the Monotributo Portal

Log in to the Monotributo portal on the AFIP website using your CUIT and tax password.

Who cannot complete digital registration? If you fall into any of the following cases, you need to access the Digital Submissions service:

a. You do not have an Argentine DNI or residency.

b. You want to register an undivided succession.

c. You have a valid DNI without an expiration date.

d. You are a minor.

3. Choose a Monotributo Category

Determine which Monotributo category is suitable for your business based on your expected annual revenue and other factors. Categories are labeled from A to K, with each having different income limits and monthly payments. This table is valid as of June 28, 2025. For updated information, please contact our team for details.

Tax Example: If your monthly income is approximately USD 4,000, and today’s rate is ARS 1410 per USD (as of Jan 20, 2026), your income would be around ARS 5,640,000, which falls under category ‘H’ in the example table. For Monotributo, your monthly fixed tax could be approximately ARS 447,400, equivalent to approximately USD 300. To declare your tax, our accountant will need the following for invoicing:

ID type and number

Full name of your customers

Transfer date

Transfer amount

As you see in this example, the tax rate is roughly less than 10% for this category.

4. Complete the Online Registration:

Visit the AFIP website and navigate to the Monotributo section. Follow the instructions for online registration, providing all the required information. You’ll need to create an AFIP account if you don’t have one.

Note: during the registration, the office corresponding to your fiscal address will appear. If you don’t have one by default because you are not represented, select one from the list, preferably the one closest to your address.

Although you can see the status of your submitted digital submissions in the website, keep in mind that you will be notified of updates through your Electronic Fiscal Domicile.

5. Generate the Volante Electrónico de Pago - VEP (Electronic Payment Slip)

After completing your Monotributo registration, the system will automatically generate an Electronic Payment Slip (VEP). This document is crucial as it allows you to make the corresponding monthly payments. The VEP contains necessary information, such as the amount to pay and the deadline, facilitating the process of complying with your tax obligations. Be sure to meet those deadlines according to the information provided in your VEP to keep your tax situation up to date.

6. Monthly Payment

Make the monthly payment of Monotributo using the VEP. Payments can be made at banks or through electronic means, depending on your preference.

7. Obtain a Monotributo Certificate:

Once your payment is confirmed, you’ll receive a Monotributo certificate. This certificate serves as proof of your enrollment in the Monotributo system. Once you have your Monotributo certificate, you can submit it to your bank to update your account profile (e.g., add your CUIT number), even if you’re using a personal account. For Monotributistas, there’s no distinction between personal and company accounts for receiving payments.

8. Fulfill Monthly Obligations

Make sure you stay on top of your monthly responsibilities. This includes submitting monthly reports and paying Monotributo on time. You need to regularly report your income and business activities and make the required payments according to the tax rules. Keeping a close eye on these tasks is crucial to follow tax regulations correctly and prevent any legal problems.

9. Annual Renewal

Remember to renew your Monotributo registration annually. AFIP will provide information on the steps to follow for this process.

Requirements for Foreigners without Argentine National Identity Document (DNI)

The granting of CUIT to foreigners is subject to General Resolution No. 3,890 (DGI) conditions. Therefore, AFIP will grant a provisional CUIT, with a maximum validity of 2 years.

During this period, foreigners must process their Argentine civic documents and communicate the assigned number. The digital procedure enabled for this is “Update and correction of registration data.” In special cases or when circumstances justify it, the intervening agency may request and/or accept other documents or proofs.

To initiate this procedure, you must indicate the following:

– The reason for the application – explain why you need a CUIT (e.g., for Monotributo registration, business activity, etc.)

– If the procedure is carried out due to having different data from RENAPER, clearly indicate what the issue is.

You must click on “Digital Submissions – Requirements” and attach:

1. Form 460/F

2. National Identity Document for native or naturalized Argentinians and foreigners. Foreigners without an Argentine National Identity Document must attach:

a. Identity card from the country of origin.

b. Certificate or proof accrediting the file number assigned by the National Directorate of Migrations, indicating the nature of their residence.

c. Photo of the face: must be facing forward, on a clear background, in a well-lit place, without glasses, and ensuring that the hair does not cover the face. Allowed formats are pdf and jpg.

If the applicant is a minor: extended age authorization from the Justice of the Peace (or the corresponding one according to the jurisdiction) or authorization from the father, mother, or guardian to engage in an activity, executed before a notary.

3. One of the instruments listed below as proof of address:

a. Argentine National Identity Document.

b. Certificate of residence issued by a competent authority.

c. Notarial certification record.

d. Proof of a service in the name of the taxpayer or responsible party.

e. Property title or lease or “leasing” contract for the property whose address is reported.

f. Bank account statement or credit card statement when the applicant is the owner of such services.

g. Municipal equivalent authorization or authorization, when the applicant’s activity is carried out in properties that require it.

h. Family Housing Certificate issued by the State Property Administration Agency, delivered by the National Social Security Administration (ANSES) in accordance with Article 48, incorporated into Annex I of Decree No. 2,670 of December 1, 2015, by Decree No. 358 of May 22, 2017.

i. Individuals whose declared fiscal address in their national identity document matches that of their father, mother, guardian, or attorney may provide the elements mentioned in points 4, 5, and 6, even if they are in the name of these individuals, provided that the birth certificate or the document certifying guardianship or power is additionally attached, as appropriate.

Once the CUIT is obtained and Monotributo registration is complete, an Electronic Payment Slip (VEP) will be automatically generated. This document is essential, as it enables you to make the monthly payments required under the Monotributo system. The VEP contains the amount due and the deadline, helping you comply with your tax obligations. Make sure to pay on time to keep your tax status in good standing.

Understanding Monotributo and SAS

Monotributo and SAS (Sociedad por Acciones Simplificada) are two different tax and legal structures used by businesses in some countries, primarily in Latin America. They serve different purposes and have distinct characteristics. Let’s talk about each of them and figure out which type of business would work for you best.

Monotributo (Monotributista)

Monotributo is a simplified tax regime used in countries like Argentina, Uruguay, and Mexico, among others. It is designed for small businesses, sole proprietors, and freelancers. Monotributistas pay a fixed monthly or quarterly tax, which is determined based on their revenue, activity, and location. They have a simplified reporting and tax payment process, making it easier for small businesses to comply with tax obligations. There are usually limitations on annual revenue and the types of activities that can be registered under Monotributo. Monotributistas may not be able to claim certain tax deductions or credits available to businesses under other tax regimes. It is generally suitable for small companies with relatively low revenue and straightforward operations.

SAS (Sociedad por Acciones Simplificada)

– Simplified Shares Company: Introduced in Argentina in 2017, the SAS revolutionizes business formation in Argentina:

– Single Shareholder Flexibility: Enables creation with just one individual or entity as the owner.

– Minimal Capital Needed: Low initial investment requirement, making it accessible for various financial backgrounds.

– Quick Setup Process: Remarkably fast establishment, often achievable within a 24-hour timeframe.

This type of Entrepreneurship is tailored to simplify and encourage business ventures in Argentina.

Other Business Types in Argentina

SA - Corporation (Sociedad Anónima - SA) - Argentina

This is a more complex type of company in terms of registration, where shareholders own the company. The more simplified version of SA is SAS, which is explained above. Let’s slightly break down SA:

The Sociedad Anónima (S.A.) caters to a wide range of business scales, from small to large corporations:

– Shareholder Flexibility: Requires at least two shareholders, with no restrictions on residency, welcoming both local and foreign investors.

– Accessible Capital Entry: Sets a minimal capital threshold of AR$100, making it feasible for diverse financial capabilities.

– Local Governance with Global Insight: Stipulates a board of directors, predominantly based in Argentina and composed of company shareholders, ensuring informed and localized decision-making while embracing global perspectives.

SRL- Limited Liability Companies (Sociedad de Responsabilidad Limitada)

This type of business is when an Individual owns the company. It’s more Personal. Let’s elaborate: The Sociedad de Responsabilidad Limitada (SRL) is a traditional legal entity format for businesses.

– Partner Range: Allows formation with 2 to 50 members, catering to small and medium-sized enterprises.

– Local Leadership Requirement: Mandates an administrative manager who is an Argentine resident, ensuring local oversight.

– Capital Structure: Capital must be segmented into stocks, offering a clear division of investment among members.

– Annual Accountability: Enforces the presentation of business reports at an annual board meeting, ensuring transparency and governance.

Monotributo vs. Argentine LLC (SRL, SA, or SAS): Which Should You Choose?

With Monotributo, you will pay less tax. For example, if your monthly income is less than USD 6,000, the tax rate is under 15%. In contrast, with an LLC, you would pay roughly double.

However, an LLC allows you to sponsor employees from abroad, while under Monotributo, you cannot issue invitation letters for foreign workers.

Conclusion

In conclusion, efficient management of your tax obligations in Argentina is crucial for maintaining a healthy fiscal position. As a Monotributo taxpayer, it is your personal responsibility to ensure that your registration and category reflect your actual income level.

For instance, if your business activity expands and your income increases, from Category A to Category B, for example, it is your duty to update your category through the Monotributo portal. Do not wait for AFIP or any authority to notify you. In Argentina’s self-declared and capitalist system, every entrepreneur is accountable for staying compliant and ensuring timely and accurate tax payments.

Proper category management helps you avoid penalties and ensures continued access to the benefits associated with the Monotributo regime.

This process may seem challenging, but with the personalized assistance of immi.legal, you will have a reliable ally who will guide you step by step and provide the necessary support to comply with tax regulations successfully. Please note that tax regulations are subject to change, and requirements may vary depending on your individual circumstances. It’s essential to stay informed about any updates or changes to the Monotributo system in Argentina.

Having the support of professionals can make a difference in your experience as a taxpayer in Argentina. Trust immi.legal to simplify your path to tax compliance!