Phone: WA: +54 9 3814 45-9254

📅 Post Date: July 26, 2024 | 🔄 Updated: January 22, 2026

Crypto in Argentina and Its Impact on the Economy

Introduction

Argentina is making exciting strides in managing its rapidly expanding cryptocurrency market with new legislation that aims to harness the potential of digital assets. In the face of high inflation and a struggling currency, Crypto assets like stablecoins and Bitcoin in Argentina have become essential tools for Argentinians seeking financial stability. The new regulations are designed to mitigate risks, such as money laundering, while fostering a supportive environment for digital asset growth. Read more information on digital assets from the official publication of the Official Gazette.

Argentina’s Crypto Market and Currency Trends

The cryptocurrency market is rapidly growing thanks to new legislation that aims to attract more and more digital immigrants to the country. Due to high inflation and a struggling currency, cryptocurrencies like stablecoins and Bitcoin in Argentina have replaced traditional currency, becoming essential tools for Argentinians in their international transactions. Moreover, the new regulations are highly beneficial and create a very supportive environment for digital currency growth.

Ambito is the website where most Argentinians check the informal ‘blue dollar’ and official ‘white dollar’ exchange rates daily: https://www.ambito.com/.

Background

In the past year, Argentina has experienced an impressive $85.4 billion in cryptocurrency transactions, marking it as one of the largest crypto markets globally. Faced with severe inflation and a declining currency, many Argentinians have embraced cryptocurrencies as a practical solution for daily transactions and financial security.

New Laws and Regulations

The Argentine government recently introduced a progressive fiscal package that includes tax amnesty for individuals declaring up to $100,000 in registered cryptocurrency assets. Roberto Silva, president of the National Securities Commission, sees this move as a crucial step toward aligning with the Financial Action Task Force (FATF) guidelines. The FATF, an international body focused on financial regulations, has encouraged Argentina to enhance its crypto regulations.

By meeting these guidelines, Argentina can avoid being placed on the FATF’s grey list, which would lead to increased scrutiny and potentially affect foreign investment. Silva views the registration of crypto assets as an initial move towards more comprehensive and positive regulation, potentially mirroring successful frameworks used in the United States.

If you have assets valued up to $100,000 USD, you do not have to pay any tax in Argentina. This includes cryptocurrency assets as well. For example, if you have $100,000 worth of cryptocurrency, you do not need to pay tax on it. For more details, refer to the official tax department website: Ley N° 27743, dated June 27, 2024, which covers fiscal measures and relevant provisions under Article 28.

Cryptocurrency in Argentina

Crypto in Argentina has gradually become a significant part of everyday life in the country. In fact, about one-third of the population now uses digital assets for transactions, positioning Argentina as a leader in crypto adoption in Latin America. Furthermore, Bitcoin in Argentina, now officially recognized as legal tender, is increasingly being used in place of traditional currencies.

In addition, President Javier Milei, a strong supporter of cryptocurrencies, has proposed laws that aim to reduce government control over financial transactions, including those involving crypto assets. Specifically, the proposed legislation suggests a favorable tax environment for cryptocurrencies, focusing on taxing capital gains and international transfers while keeping direct taxation low.

Is Cryptocurrency Mining Illegal in Argentina?

Cryptocurrency mining in Argentina is not illegal, as correctly noted by ONG Bitcoin Argentina, a nonprofit organization that promotes Bitcoin education, adoption, and legal clarity in the country. Crypto money you can trade or use for payments (Resolución 49/2024, Art. 2°). They are not official money in Argentina. Recent government inspections targeted documentation and import compliance, not the act of mining itself. Authorities and industry experts continue to call for clear regulations to provide legal certainty and support the sustainable growth of the country’s crypto sector.

In Argentina, cryptocurrency mining is recognized as a digital infrastructure and high-performance computing activity, separate from the issuance of legal currency. This recognition allows companies, including Virtual Asset Service Providers, to operate openly under global corporate, tax, and energy regulations, while complying with anti-money laundering rules and reporting requirements, rather than needing a financial services license.

Business Operations, Invoicing, and Tax Declaration

Argentine businesses can integrate cryptocurrency into daily operations by accepting crypto payments for goods and services and converting those digital assets into Argentine pesos through regulated exchanges or P2P platforms. Once the funds are credited to a local bank account, companies can issue invoices in pesos and use the proceeds to cover operational expenses, pay vendors, or remit payroll, provided that all inflows are documented with bank statements and transaction records. This practice allows companies to leverage crypto for routine business activities while maintaining full compliance with Argentine tax and corporate regulations, reinforcing Argentina’s growing ecosystem for digital assets.

For more accurate guidance crypto operations and taxes, please book a consultation with a corporate accountant and tax lawyer.

Building Argentina’s Crypto Professionals

Argentine universities are actively preparing professionals for the growing cryptocurrency sector. UNER offers a free course on blockchain and cryptocurrencies, while UCALP teaches smart contracts, blockchain fundamentals, and legal frameworks. UNCUYO provides an in-person program on the crypto economy and investment strategies, and UNCAus runs a 16-week diploma covering DeFi, smart contracts, regulations, and secure investing. The University of Buenos Aires (UBA) Rojas Cultural Center adds a practical online course introducing cryptocurrencies, NFTs, and real-world applications. Together, these programs reflect a nationwide effort to equip Argentinians with the skills needed to thrive in the country’s expanding digital asset economy.

Innovative Energy Approaches for Crypto Mining

Following the example of Vaca Muerta, where Unblock Computing partnered with Crusoe Energy and local energy companies to build a large bitcoin mining farm using oilfield gas, Argentina is also using innovative energy solutions for crypto mining. Genesis Digital Assets (GDA), together with YPF Luz, opened a bitcoin mining facility in Neuquén that runs on stranded gas, powering 1,200 miners with 7 MW of capacity. This project reduces wasted gas and shows how crypto mining can work alongside Argentina’s energy needs, making the country an attractive place for sustainable, large-scale crypto operations.

Crypto Mining Electricity Costs in Argentina

Electricity pricing in Argentina is structured through the Wholesale Electricity Market (MEM) and the Tierra del Fuego system (MEMSTDF), regulated by the government, with rates periodically adjusted through seasonal programming. As of August 1 to October 31, 2025, the stabilized energy price for residential users in Buenos Aires (Level 1) (ANEXO I ), while excess consumption is billed at the corresponding wholesale prices (ANEXO IV). By contrast, electricity for industrial or large-scale consumption, including cryptocurrency mining, is charged at the reference price: ≈ USD 0.03 per kWh + approximately another 0.01 USD (structure maintenance costs), highlighting a substantial difference between domestic and industrial rates. These rates and rules are detailed in Resolution 334/2025 of the Official Gazette of the Argentine Republic. USD prices may vary depending on currency fluctuations at the time of reading.

Electricity Consumption – Apartment Example

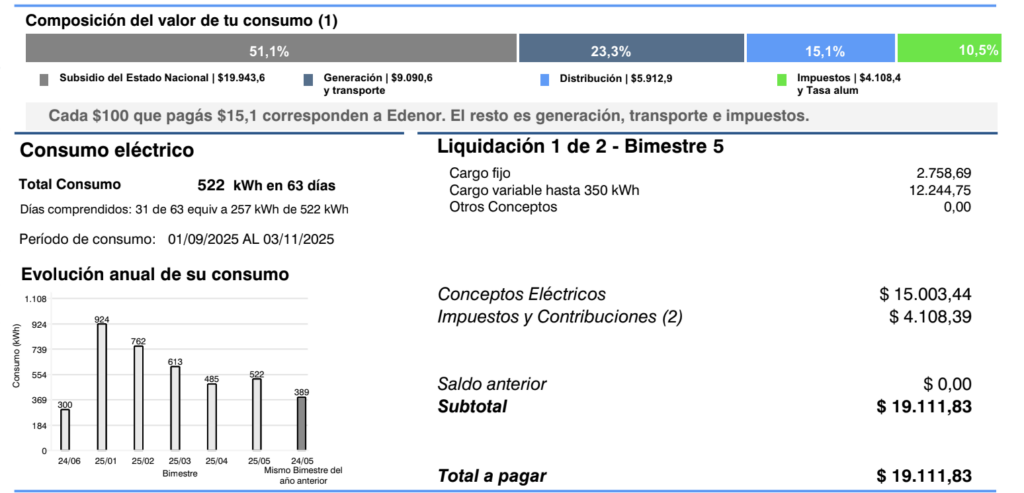

Consumption Period: 09/01/2025 to 11/03/2025 (Billing (1 of 2) – Two-Month Period (5))

Total Consumption – 522 kWh over 63 days

Composition of Your Consumption Value (1)

51.1% National Government Subsidy | ARS$ 19,943.6

23.3% Generation and Transmission | ARS$ 9,090.6

15.1% Distribution | ARS$ 5,912.9

10.5% Taxes and Student Tax | ARS$ 4,108.4

Of every ARS$ 100 you pay, ARS$ 15.1 goes to Edenor. The remainder covers generation, transmission, and taxes.

Days Included in This Bill

31 of 63 days, equivalent to 257 kWh of the total 522 kWh

Fixed Charge: ARS$ 2,758.69

Variable Charge (up to 350 kWh): ARS$ 12,244.75

Electricity Charges

Electricity Charges: ARS$ 15,003.44

Taxes and Contributions (2): ARS$ 4,108.39

Total Amount Due : ARS$ 19,111.83

Energy-only: ~0.033 USD/kWh (official exchange rate Jan 20, 2026)

After taxes: ~0.052 USD/kWh)

Example for Crypto Mining Energy Consumption

For example, immersion-overclocked Antminer S19 Pro/S19 XP or WhatsMiner M50/M50S units typically draw approximately 5.4 kW per ASIC. Assuming a container populated with approximately 200 immersion-cooled machines (single-phase or two-phase, not air-cooled), the total electrical load is roughly 1 MW per container, with the cost of a single container estimated at USD 5–6 million. Setting up a mining farm with of deployment of approximately 20 containers would consume about 500,000 kWh per day (~20 MW/day); roughly 50 containers would consume approximately 1,000,000 kWh per day (~40 MW/day); and approximately 70 containers would consume about 1,500,000 kWh per day (~60 MW/day), depending on operating conditions and overclocking profiles. At an electricity cost of USD 0.033 per unit, 20 containers consume USD 0.3 million, 50 containers USD 0.6 million, and 70 containers USD 0.9 million monthly for electricity alone. Impressively, all of this can fit on a relatively compact footprint, as only about 0.5–1 hectare of land is needed per container cluster.

Is Gas-Generated Electricity Cheaper for Mining?

Electricity from the grid may be expensive for large consumers, while natural gas is relatively cheap, especially near Vaca Muerta in Neuquén Province, Patagonia. By using gas generators with low-cost gas, electricity can be produced at a lower cost per kWh than grid power, making on-site generation a cheaper option for crypto mining. A 10 MW power plant can be built in approximately 3–4 months, and an additional 10 MW plant can be constructed simultaneously. The estimated infrastructure cost is about USD 700,000 per MW (including substation, transformer, and other necessary equipment); therefore, a 20 MW facility would require an investment of approximately USD 14 million.

Economic Impact of Cryptocurrency in Argentina and Future Outlook

Under President Javier Milei’s administration, Argentina has introduced strong market-oriented reforms focused on simplifying taxes, reducing bureaucracy, and restoring trust between the government and citizens. Through ARCA, the tax system is now more digital, transparent, and predictable, making it easier for individuals, investors, and companies to operate in the country.

At the same time, the government is supporting financial innovation by allowing greater use of foreign currencies and digital assets in private transactions. Together with clearer rules for crypto activities and the arrival of major exchanges, these policies are positioning Argentina as a regional hub for digital infrastructure, blockchain technology, and large-scale computing services, attracting investment beyond trading into long-term technology operations.

Positive Developments of Bitcoin in Argentina and Opportunities

Although challenges remain, such as the IMF’s call for restrictions to prevent money laundering and the central bank’s 2023 ban on unregulated crypto services, the overall outlook for Argentina’s cryptocurrency sector is promising. In response, the new regulation requiring crypto service providers to register aims to enhance oversight and support a thriving market.

President Milei’s mixed signals regarding crypto demonstrate a dynamic approach to integrating digital assets into the economy. However, his administration’s commitment to creating a clear and supportive regulatory framework strategically positions Argentina to capitalize on the benefits of cryptocurrency while addressing regulatory concerns. As a result, this will create numerous job opportunities in the private sector. Furthermore, many digital professionals can immigrate to Argentina and contribute to the local economy.

Conclusion

Argentina’s advancements in cryptocurrency regulation reflect a proactive approach to managing a rapidly growing sector. The new laws and reforms demonstrate the country’s dedication to fostering a favorable environment for digital assets, with a focus on balancing regulation and innovation. As Argentina continues to navigate its economic challenges, its position as a leading player in the global cryptocurrency market is becoming increasingly solid. The coming months will reveal how these positive changes will shape the future of Argentina’s crypto landscape and its broader economic health.

If you need assistance incorporating a company in Argentina, contact us to discuss the details.

For more information about immigration to Argentina, please visit https://immi.legal/how-to-immigrate-to-argentina/